In the rapidly advancing digital era, managing finances effectively and securely has become more crucial than ever. Financial institutions have been at the forefront of innovation, offering tools and platforms to help individuals and businesses navigate the complexities of modern banking. Among these institutions, Mid Oregon Credit Union has emerged as a leader, providing a robust suite of online and mobile banking solutions that empower users to take control of their financial well-being.

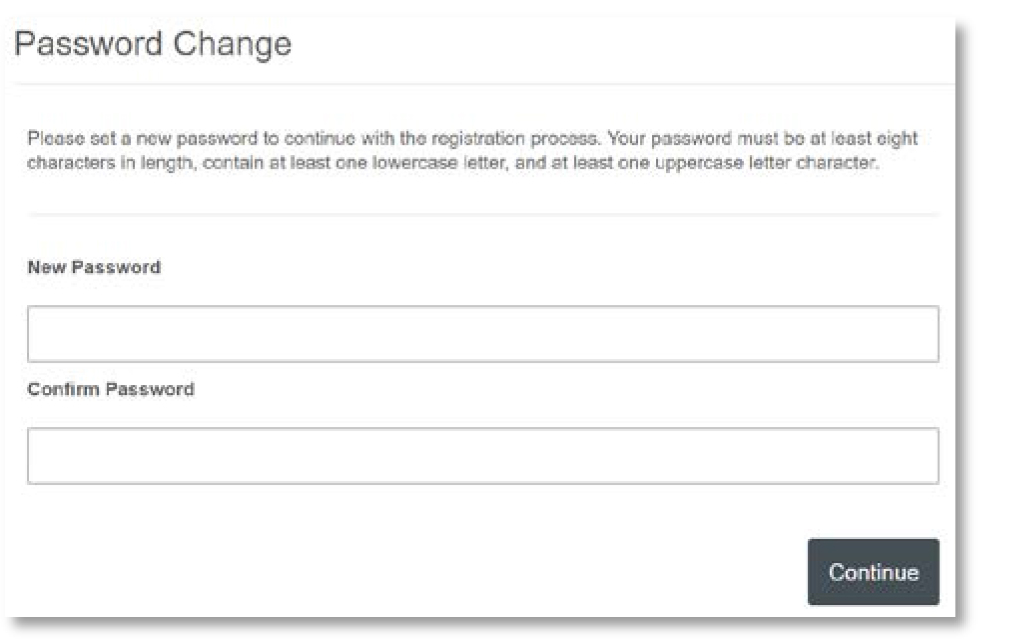

The digital transformation of banking has revolutionized how people interact with their money. Gone are the days of long queues at physical branches; today, everything from account management to loan applications can be done with just a few clicks. Mid Oregon Credit Union recognizes this shift and has tailored its services to meet the evolving needs of its members. By leveraging cutting-edge technology, the credit union ensures that its offerings are not only convenient but also secure, giving users peace of mind as they manage their finances.

| Feature | Description |

|---|---|

| Online Account Access | 24/7 access to your accounts from any device with an internet connection. |

| Mobile Banking App | Banking on the go, with features like mobile deposit and account alerts. |

| eStatements | Receive your monthly account statements electronically for convenience and security. |

| Bill Pay | Pay your bills online, saving time and postage. |

| Account Transfers | Easily transfer funds between your Mid Oregon Credit Union accounts or to external accounts. |

| Loan Applications | Apply for loans online with a fast, easy, and secure process. |

| Card Management | Manage your debit and credit cards, including setting spending limits and receiving fraud alerts. |

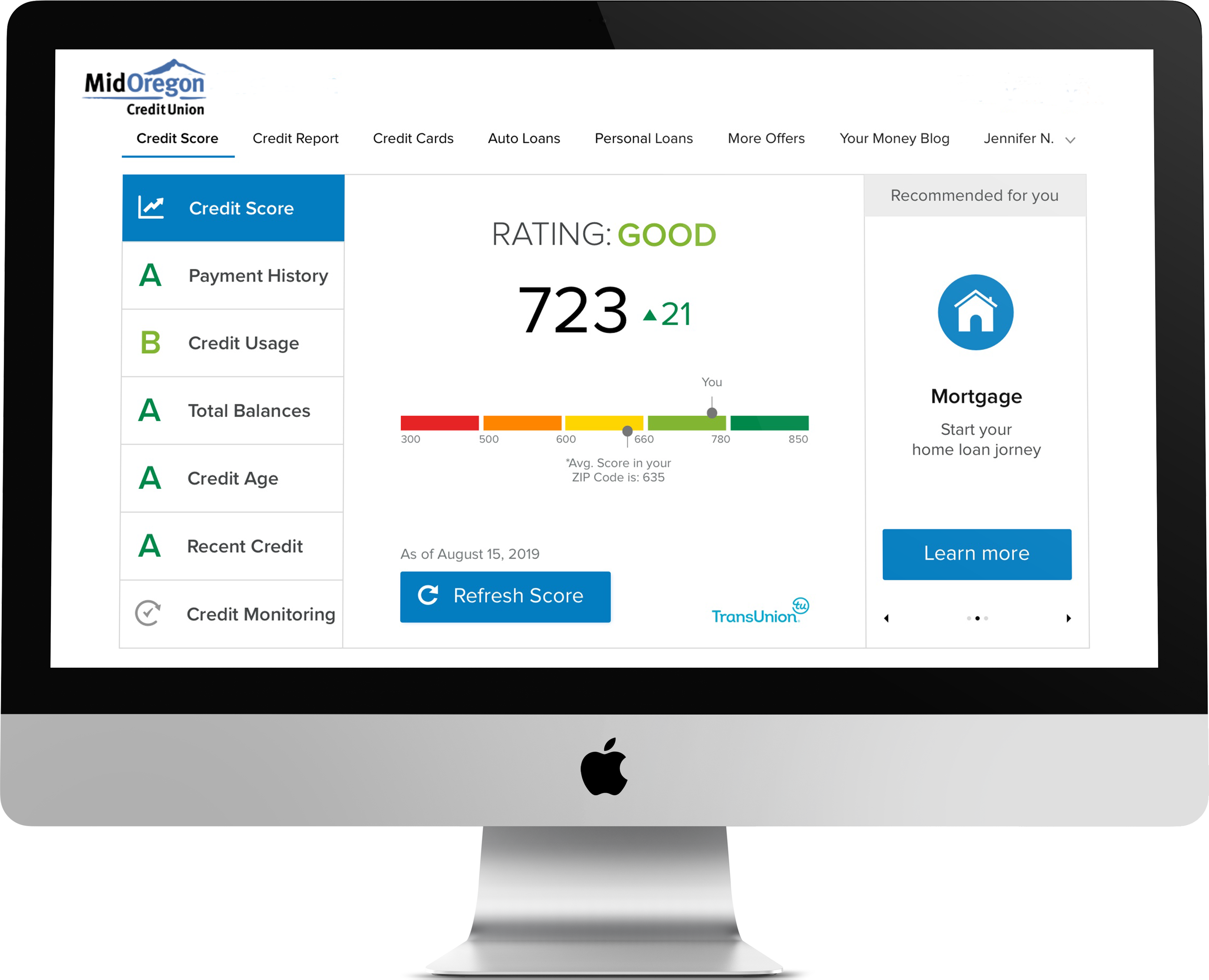

| Credit Savvy | Access free credit reports and tools to monitor and improve your credit score. |

| Commercial Services | Tailored financial solutions for businesses, including online banking, loans, and merchant services. |

| Automated Payments | Set up recurring payments from your checking account to avoid late fees and ensure timely payments. |

For businesses, the digital solutions provided by Mid Oregon Credit Union extend beyond individual account management. The credit union offers a range of commercial services designed to streamline operations and enhance productivity. From online banking platforms that allow businesses to manage their accounts effortlessly to specialized loan options tailored to meet specific needs, Mid Oregon Credit Union ensures that its business clients have access to the tools they require to succeed in today’s competitive market.

- Bollyflixvip Your Ultimate Guide To Movies Downloads And Beyond

- Sone436 The Rising Star In Gaming And Entertainment

One of the standout features of Mid Oregon Credit Union’s digital offerings is its mobile banking app. This app empowers users to perform a wide array of banking activities from their smartphones or tablets. With features such as mobile check deposit, account alerts, and bill pay, the app provides unparalleled convenience. Users can deposit checks remotely, receive instant notifications about account activity, and pay their bills without ever stepping foot into a physical branch. These capabilities not only save time but also enhance security, as users can monitor their accounts in real-time and quickly address any suspicious activity.

Another essential tool offered by Mid Oregon Credit Union is its card management service. This feature allows users to set spending limits, receive fraud alerts, and temporarily disable their cards if they suspect unauthorized use. In an age where identity theft and financial fraud are growing concerns, these security measures provide users with the assurance they need to bank confidently. Additionally, the credit union’s Credit Savvy program offers members access to free credit reports and tools to monitor and improve their credit scores. This initiative reflects Mid Oregon Credit Union’s commitment to educating its members and helping them achieve financial stability.

The impact of Mid Oregon Credit Union’s digital services extends beyond individual users and businesses. In a society where financial literacy is increasingly important, the credit union plays a vital role in promoting financial education and empowerment. By providing tools and resources that make banking accessible and understandable, Mid Oregon Credit Union contributes to the overall financial health of its community. This aligns with broader societal trends where financial institutions are expected to do more than simply facilitate transactions; they are called upon to serve as partners in their members’ financial journeys.

- Vegamovues The Ultimate Guide To This Rising Star In The Streaming World

- Sara Saffari Nude Unveiling The Truth And Setting The Record Straight

The adoption of digital banking solutions by Mid Oregon Credit Union also reflects a larger industry trend. As technology continues to evolve, financial institutions worldwide are investing heavily in digital transformation. This shift is driven by both consumer demand and the need to remain competitive in an increasingly globalized market. Companies like JPMorgan Chase, Bank of America, and even fintech startups such as Chime and Robinhood are all vying for a share of the digital banking landscape. Mid Oregon Credit Union’s commitment to innovation ensures that it remains relevant and competitive in this dynamic environment.

Moreover, the credit union’s focus on security and user experience sets it apart from many of its competitors. In an era where data breaches and cyberattacks are commonplace, trust is a critical factor for consumers choosing a financial institution. Mid Oregon Credit Union’s dedication to safeguarding its members’ information, coupled with its user-friendly interfaces, fosters a sense of loyalty and reliability among its clientele. This approach resonates with both tech-savvy millennials and older generations who value simplicity and security.

Looking ahead, the future of digital banking holds exciting possibilities. Advances in artificial intelligence, blockchain technology, and biometric authentication promise to further enhance the user experience while strengthening security protocols. Mid Oregon Credit Union is well-positioned to embrace these innovations, ensuring that its members continue to benefit from the latest advancements in financial technology. As the credit union expands its digital footprint, it will undoubtedly play a pivotal role in shaping the future of banking in Central Oregon and beyond.

In conclusion, Mid Oregon Credit Union’s comprehensive suite of online and mobile banking solutions represents a significant step forward in the realm of digital finance. By offering a wide array of features designed to meet the diverse needs of its members, the credit union exemplifies what it means to be a modern financial institution. Its commitment to innovation, security, and education positions it as a leader in the industry, setting a standard for others to follow. As the digital landscape continues to evolve, Mid Oregon Credit Union remains a trusted partner for individuals and businesses seeking to manage their finances effectively and securely.

For those interested in learning more about Mid Oregon Credit Union’s digital services, additional information can be found on their official website. Visit https://www.midoregon.org to explore the full range of offerings and discover how these tools can enhance your financial well-being.

- Vigamoves The Ultimate Guide To Boosting Your Fitness Journey

- Rory John Gates The Rising Star Whos Making Waves