The financial landscape is rapidly evolving, with technology playing an increasingly pivotal role in shaping how individuals interact with their money. Mid Oregon Credit Union has positioned itself at the forefront of this transformation by introducing a state-of-the-art digital banking platform. This new era of financial freedom empowers users to take control of their finances seamlessly, securely, and intuitively. As society continues to embrace digital tools for everyday tasks, financial institutions must adapt to meet the growing demand for convenience and accessibility. Mid Oregon Credit Union understands this imperative and has developed a platform that not only meets but exceeds expectations.

In today's fast-paced world, where time is a precious commodity, the ability to manage finances effortlessly is more important than ever. The digital banking solution offered by Mid Oregon Credit Union allows users to access their accounts, transfer funds, pay bills, and more from anywhere at any time. This flexibility aligns with the broader trend of financial institutions leveraging technology to enhance customer experience. Companies like PayPal, Venmo, and even global banking giants such as JPMorgan Chase have recognized the importance of offering robust digital platforms. By investing in cutting-edge technology, Mid Oregon Credit Union ensures its members remain competitive and connected in an increasingly digital economy.

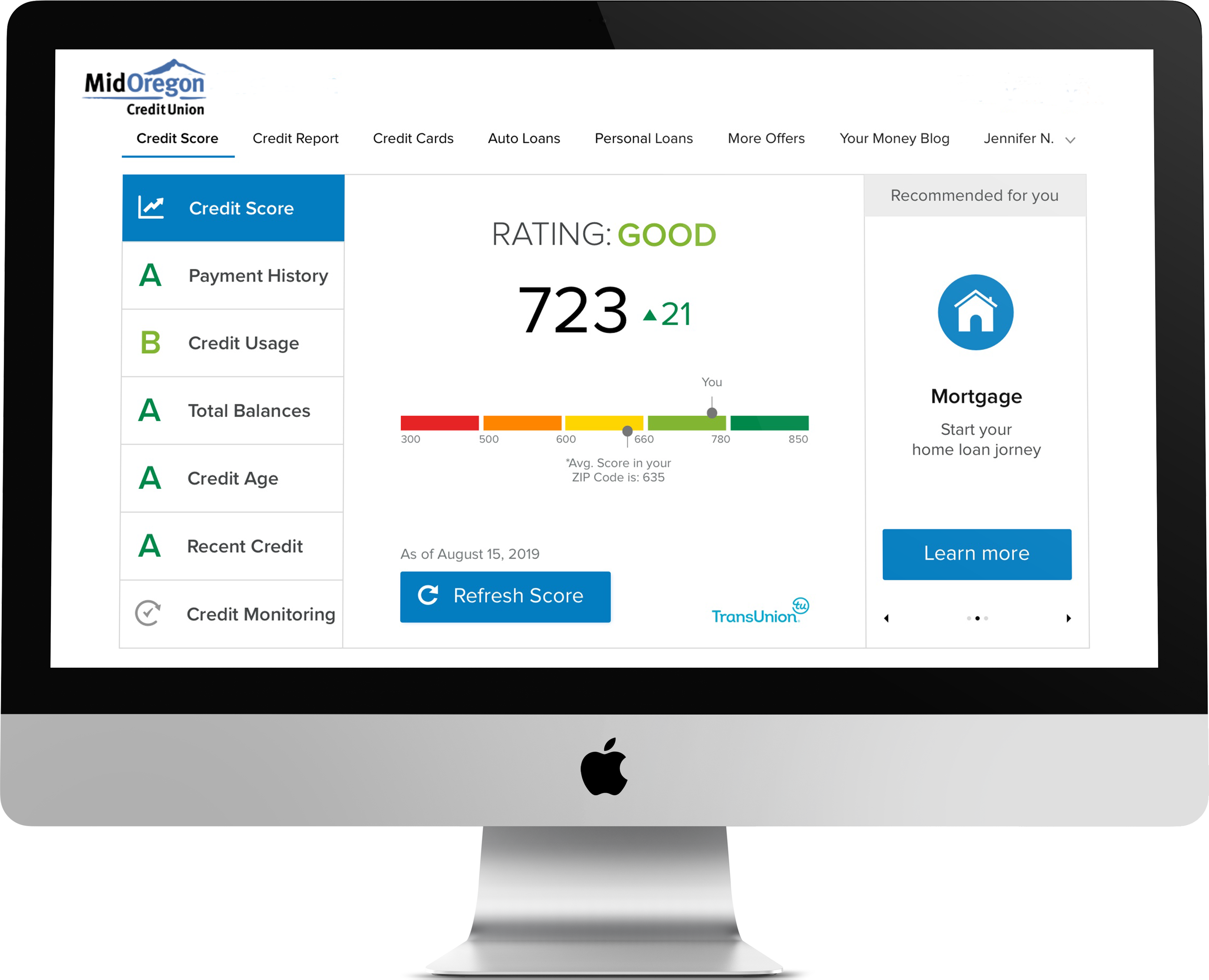

| Mid Oregon Credit Union Digital Banking Platform Information | |

|---|---|

| Feature | Details |

| Platform Name | Mid Oregon Credit Union Digital Banking Platform |

| Accessibility | Web and Mobile App (iOS & Android) |

| Security Features | Multi-factor authentication, encryption, fraud monitoring |

| Account Management | Check balances, view transaction history, download statements |

| Fund Transfers | Transfer funds between accounts, external transfers to other financial institutions |

| Bill Payment | Pay bills online, set up recurring payments |

| Mobile Deposit | Deposit checks using your smartphone camera |

| Card Management | Turn debit cards on/off, set spending limits, report lost or stolen cards |

| eStatements | Access electronic statements with online check images |

| Customer Support | In-app messaging, phone support, branch locations |

| Branches Locations | Bend, Redmond, La Pine, Sisters, Madras & Prineville |

| Service Area | Deschutes, Crook, Jefferson, Wheeler, Lake, and North Klamath counties within the COCC taxing district. |

| Official Website | Mid Oregon Credit Union |

The digital banking platform is not merely a tool for convenience; it represents a fundamental shift in how financial institutions engage with their customers. By incorporating advanced security features such as multi-factor authentication and encryption, Mid Oregon Credit Union ensures that user data remains protected against cyber threats. In an era where data breaches and identity theft are significant concerns, trust becomes the cornerstone of any successful financial relationship. This focus on security resonates with the approach taken by industry leaders like Apple Pay and Google Pay, who prioritize user safety while delivering innovative solutions.

- Somali Telegram 2025 A Deep Dive Into The Future Of Communication

- Bollyflixwin Bollywood The Ultimate Destination For Bollywood Enthusiasts

Beyond security, the platform's comprehensive account management capabilities further enhance its appeal. Users can check balances, view transaction histories, and download statements with ease, all from the convenience of their smartphones or computers. These functionalities are particularly relevant in a society where instant access to information is expected. Moreover, the ability to transfer funds between accounts or conduct external transfers to other financial institutions streamlines the process of managing multiple accounts. This level of functionality mirrors the offerings of fintech startups like Robinhood and Betterment, which have disrupted traditional banking models by providing user-friendly interfaces and advanced features.

The inclusion of bill payment options and mobile deposit capabilities adds another layer of convenience to the platform. Paying bills online and setting up recurring payments eliminates the need for manual checks and stamps, saving both time and resources. Similarly, the mobile deposit feature allows users to deposit checks using their smartphone cameras, eliminating trips to physical branches. These features reflect the broader trend of digitizing routine financial tasks, a movement championed by companies like Zelle and Square, which have revolutionized peer-to-peer payments and small business transactions, respectively.

Card management tools provide users with greater control over their debit cards, enabling them to turn cards on/off, set spending limits, and report lost or stolen cards directly through the app. This level of customization empowers users to safeguard their accounts and prevent unauthorized transactions. The integration of eStatements further enhances the platform's appeal by offering electronic statements with online check images, reducing paper waste and promoting environmental sustainability. These eco-friendly initiatives align with the growing emphasis on corporate responsibility and sustainability within the financial sector.

- Anjali Arora Mms Link The Untold Story And Facts You Need To Know

- Barry Weiss Storage Wars The Ultimate Guide To The Auction King

Customer support plays a crucial role in ensuring a seamless user experience, and Mid Oregon Credit Union's digital banking platform excels in this area. In-app messaging, phone support, and access to branch locations create multiple avenues for users to seek assistance when needed. This multi-channel approach to customer service reflects the strategies employed by leading financial institutions like Bank of America and Wells Fargo, who recognize the importance of maintaining strong customer relationships in a competitive market.

The service area covered by Mid Oregon Credit Union includes Deschutes, Crook, Jefferson, Wheeler, Lake, and North Klamath counties within the COCC taxing district. This regional focus allows the credit union to tailor its offerings to the specific needs of its local community, fostering a sense of connection and belonging among its members. By understanding the unique challenges and opportunities faced by residents in these areas, Mid Oregon Credit Union can provide personalized solutions that resonate with its audience.

The impact of Mid Oregon Credit Union's digital banking platform extends beyond individual users to influence broader societal trends. As more people adopt digital banking solutions, the demand for traditional branch services declines, prompting financial institutions to rethink their operational models. This shift has significant implications for employment, as fewer physical branches may lead to job losses in certain sectors. However, it also creates new opportunities for innovation and growth, as financial institutions invest in technology and digital infrastructure.

The adoption of digital banking solutions also contributes to financial inclusion, enabling individuals who may not have access to traditional banking services to participate fully in the economy. By providing a secure and user-friendly platform, Mid Oregon Credit Union helps bridge the gap between underserved communities and mainstream financial services. This commitment to inclusivity aligns with global initiatives aimed at promoting economic empowerment and reducing poverty.

In conclusion, Mid Oregon Credit Union's digital banking platform represents a significant advancement in the financial industry, offering users unparalleled convenience, security, and functionality. By embracing cutting-edge technology and prioritizing customer needs, the credit union sets a benchmark for excellence in digital banking. As society continues to evolve, the importance of digital solutions in managing finances will only increase, making platforms like Mid Oregon Credit Union's essential tools for navigating the complexities of modern life.

- Subhashree Sahu Mms Link The Untold Story And What You Need To Know

- Mastering Remoteiot Monitoring Ssh Download For Mac A Comprehensive Guide